Name and Describe Four Commonly Used Sources of Short-term Financing.

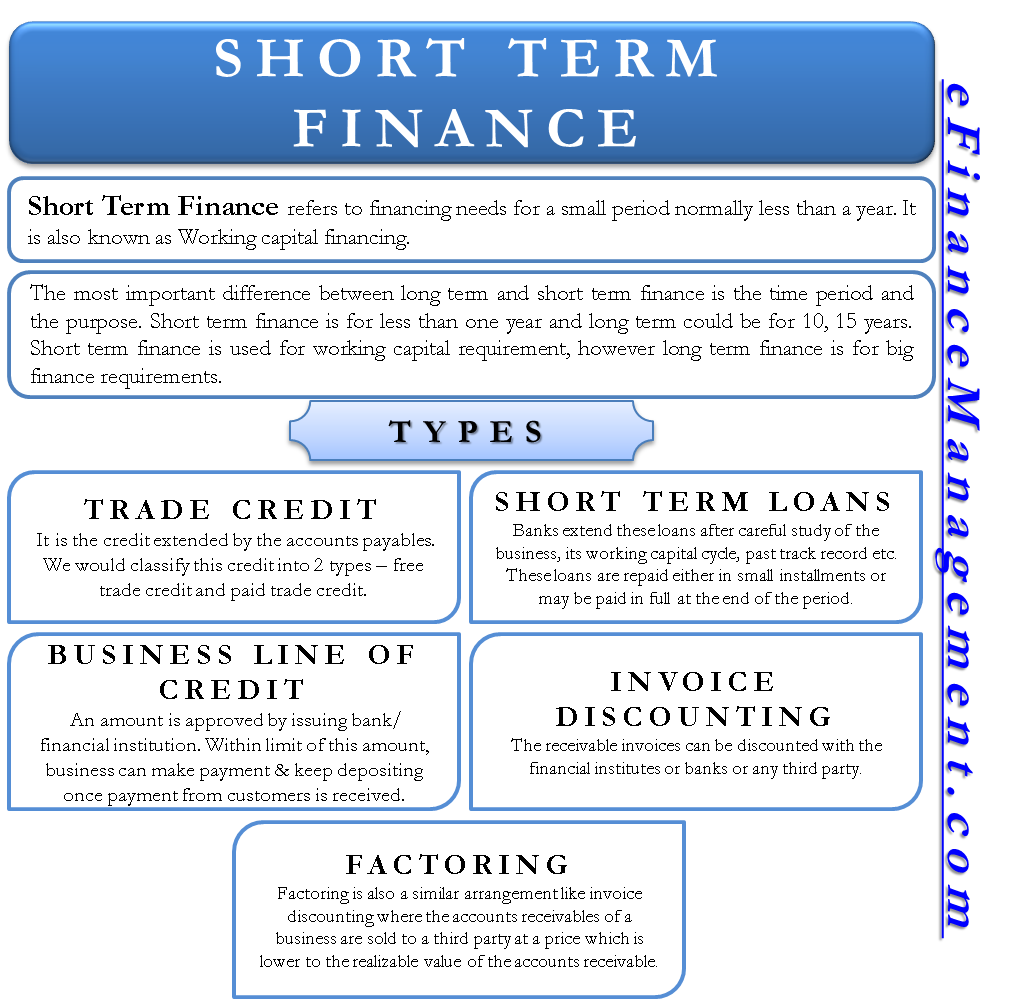

Short term financing means the financing of business from short term sources which are for a period of less than one year and the same helps the company in generating cash for working of the business and for operating expenses which is usually for a smaller amount and it involves generating cash by online loans lines of credit invoice financing. Short term financing examples.

Short Term Finance Types Sources Vs Long Term Efinancemanagement

Short-Term Bank Loans they are usually due in 30 to 90 days.

. For short-term financing need of a small business commercial banks are a good choice. View Homework Help - Chapter_Nine_Assignment from BUSE 100 at San Diego Miramar College. Free trade credit is credit received during the discount period and costly trade credit is credit whose cost is an implicit one based on the foregone discount.

Accounts payable or trade credit is the largest single category of short-term debt for many businesses. Factoring firms can also obtain short-term financing by using the services of a factor. Name and describe 4 commonly used sources of short term financing Trade Credit from MRKG 1301 at Lone Star College System Woodlands.

Name and describe 4 commonly used sources of short-term financing. Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations. Name and describe 4 commonly used sources of short-term financing.

Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations. Short-term Bank loans are usually due in 30-90 days. Equity Financing and Debt Financing.

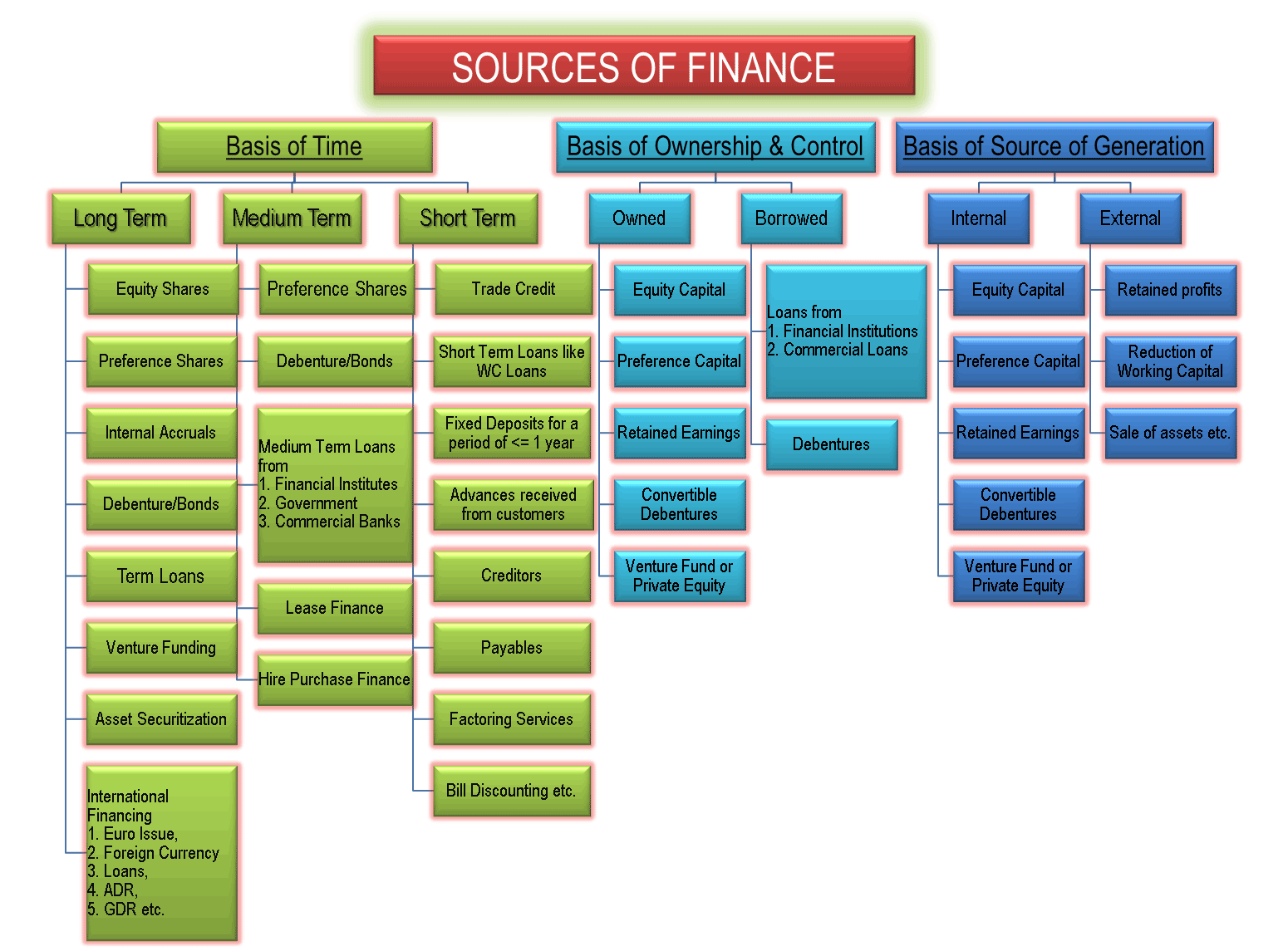

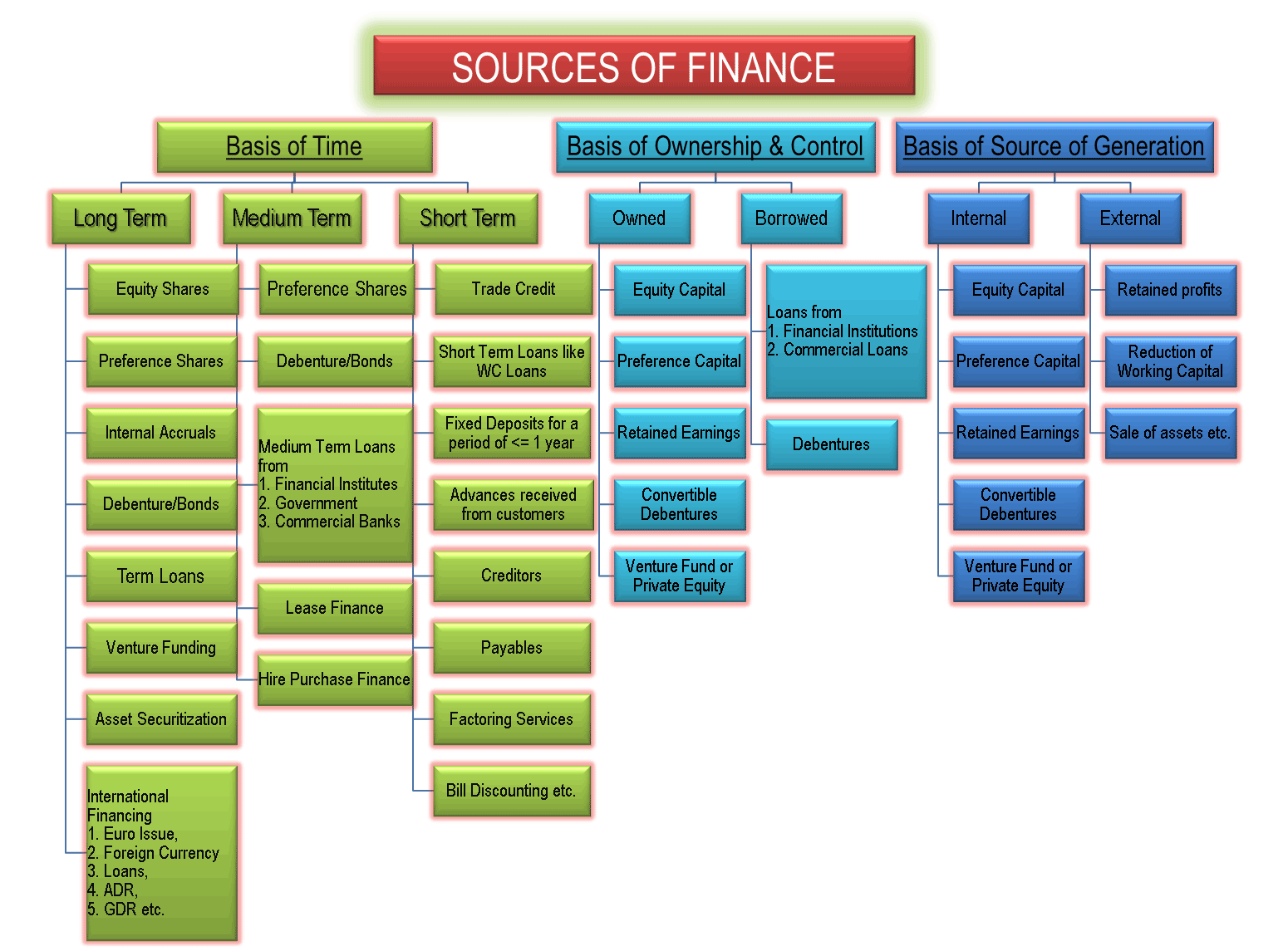

Following are the sources of short-term financing. There are some of the sources of short term financing which you might not be aware of it. Name and describe four commonly used sources of short term financing a Short from ECON 1234 at LN STEM Academy.

Name and describe 4 commonly used sources of short-term financing. Name and describe four commonly used sources of short term financing Four from MGMT 130 at Rochester Institute of Technology. The four basic types of financial ratios used to measure a companys performance are liquidity ratios asset management ratios leverage ratios and profitability ratios.

Short Term Financing Definition. Lines of credit a bank agrees to lend a. The four commonly used sources of short-term financing are trade credit factoring short-term bank loans and commercial paper.

Short term financing The firm relies on trade credit bank or government financing and borrowing in the wholesale money markets by way of commercial paper or LIBOR- based loans international. Name and describe 4 commonly used sources of short-term financing. Factoring firms can also obtain short-term financing by using the services of a factor.

This article throws light upon the ten main sources of short-term fund. Trade credit is when a seller ships goods to a firm without requiring immediate payment. Sources of Financing for small business or startup can be divided into two parts.

Short-Term Bank Loans they are usually due in 30 to 90 days. Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations. In many countries people who are faced with severe financial hardships that involve potential foreclosure eviction or legal fees are sometimes able to take out short-term loans that are secured against company pension plans.

There are various types of short term sources of finance available in current market. Short-Term Bank Loans they are usually due in 30 to 90 days. Some common source of financing business is Personal investment business angels assistant of government commercial bank loans financial bootstrapping buyouts.

Documentary Letter of Credit Revocable Letter of Credit Finance against Securities Fixed Letter of Credit Purchasing and Discounting of Bills and more. Name and describe four commonly used sources of short-term financing. Let us discuss the sources of financing business in greater detail.

Bus 110 1 Name and describe four commonly used sources of short-term financing. Banks provide three kinds of loans Single End-of-period Payment Loan firms pay fixed or variable interest on the loan and payback the principal sum in lump sum at the end of the loan. Factoring firms can also obtain short- term financing by using the services of a factor.

Pension plan loans are among the short-term financing sources that some consumers turn to during times of hardship. Describe the purpose of a cash budget and the four commonly used sources of. Factorizing or asset securitization.

Expert solutions for 5Name and describe 4 commonly used sources of short-term financing. View Chapter 9docx from BUS 110 at Mitchell Community College. List the four basic types of financial ratios used to measure a companys performance give an example of each type of ratio and explain its significance.

Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations. Short-Term Bank Loans they are usually due in 30 to 90 days.

Sources Of Finance Owned Borrowed Long Short Term Internal External

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Short Term Financing Definition Example Overview Of Top 5 Types

Comments

Post a Comment